Why ServiceNow Customers Still Need a Dedicated SaaS Management Tool in 2026

For most large enterprises, ServiceNow sits at the heart of IT service management. Even with its dashboards and automation, teams still get surprised by a fast-growing line item: SaaS spend. The missing piece is a clear view of the countless subscriptions employees spin up without looping in IT.

A single credit card swipe can launch a new cloud application well beyond ServiceNow’s discovery range. Without an accurate inventory, security chases risk, finance chases invoices, and everyone questions the data. The fallout is wasted budget and unnecessary exposure. When audit season arrives, those blind spots become urgent boardroom questions no one wants to field unprepared.

Linking ServiceNow with a purpose-built SaaS management platform fills in the shadows. Together they surface hidden apps, right-size licenses, and lock down governance from the first purchase to the final audit.

Table of Contents

- Where ServiceNow Shines Today

- The SaaS Blind Spots ServiceNow Misses

- Digging Deeper Into SaaS Spend

- Automating License Governance and Compliance

- Bringing SaaS Management and ServiceNow Together

- Conclusion

- Audit your company's SaaS usage today

Where ServiceNow Shines Today

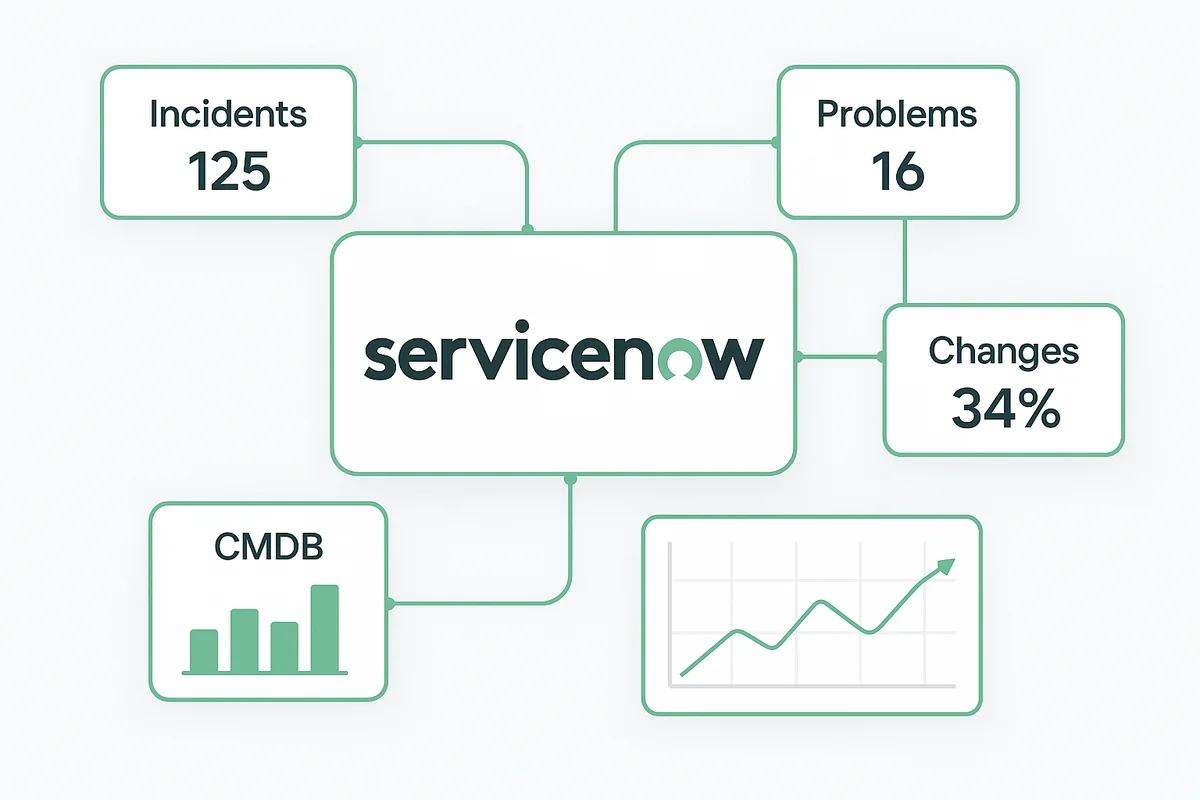

ServiceNow sits at the heart of many IT operations teams worldwide. Born as a ticketing system, the platform now anchors core IT service management routines that most enterprises rely on day in, day out. Incident queues, change approvals, and problem reviews all live in one place, mapped back to the configuration management database so relationships stay clear and audit trails stay intact.

Most daily tasks now run through that single pane of glass. When a server outage hits, the incident record links directly to the affected asset in CMDB, pulls in recent change history, and kicks off a predefined resolution playbook without a scramble for context. Teams move from reactive firefighting to repeatable processes because the same approach covers password resets, data center maintenance windows, and quarterly software upgrades. One interface, one data model, one language for IT.

Consistency comes from ServiceNow’s low-code tooling rather than handwritten scripts. Flow Designer lets system admins drag, drop, and publish approval paths or notification rules in minutes instead of coding integrations line by line. A junior analyst can build a self-service catalog item that spins up a virtual machine, tags it to a cost center, and updates CMDB fields before the coffee gets cold. Governance stays tight because every action is versioned, permissioned, and reportable right in the platform.

Dashboards tie the story together for leaders who need quick proof of progress. Leaders open the workspace each morning, and within seconds they see:

- Mean time to resolution by business service

- Top recurring problems sorted by asset class

- Change success rate alongside emergency change count

- Real-time hardware capacity and data center temperature trends

With that snapshot, a director can spot a spike in failed changes, drill into the offending server cluster, and launch a root-cause task during the same session.

ServiceNow already provides the operational backbone companies depend on for uptime, accountability, and speed. The question isn’t whether it works; it’s how to extend that discipline to the ever-growing universe of SaaS.

The SaaS Blind Spots ServiceNow Misses

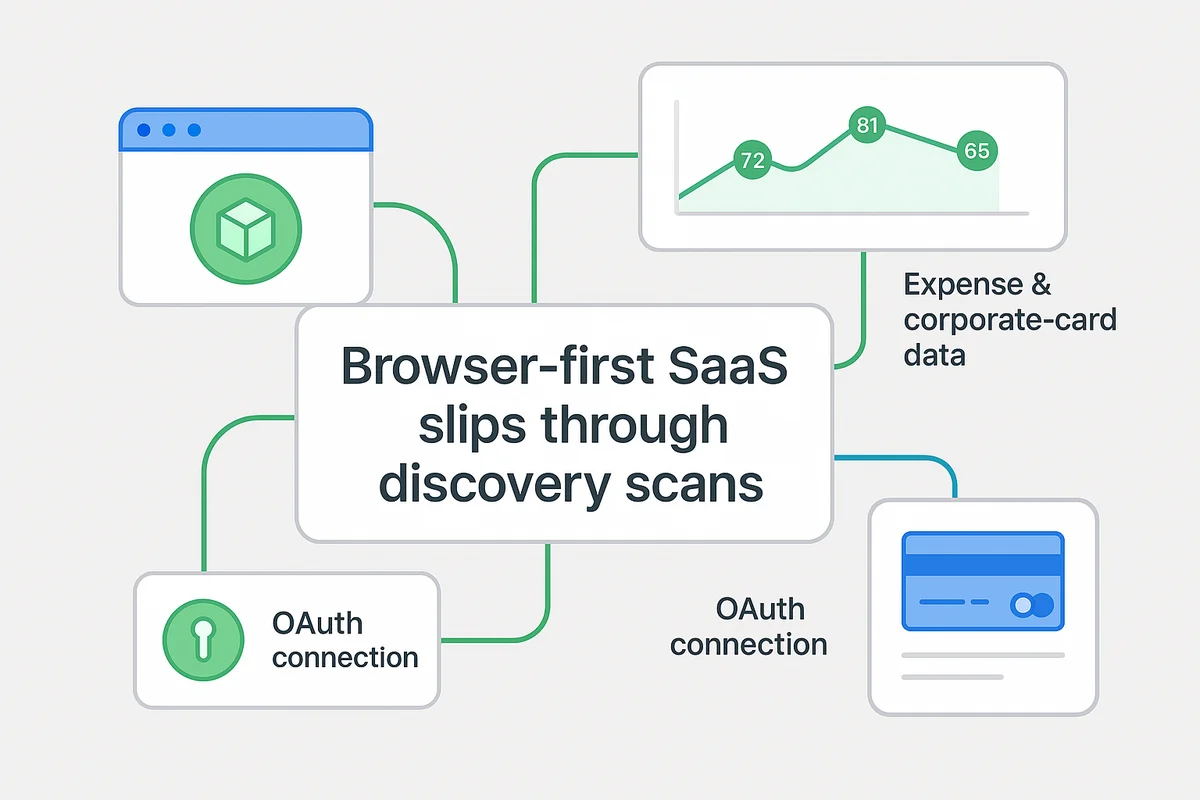

ServiceNow runs discovery scans, yet browser-first SaaS slips through almost every time. Those tools live inside personal browsers rather than data centers, leaving traditional asset discovery blind to their presence.

Teams adopt tools like Miro or Airtable with a personal credit card, the receipt hits Concur, and the login happens in Chrome, well outside any data center probe. LDAP never sees the account, so the CMDB stays silent. By the time finance spots the charge, the workspace holds customer data and API keys.

Most SaaS management platforms start the hunt with a different playbook. They begin where the apps live, pulling from the vendor’s APIs and the company’s spend records, then stitch those feeds against identity data. Because this monitoring runs continuously, not just during a quarterly audit, new workspaces appear in hours instead of months.

- Direct OAuth connections capture user, role, and feature usage straight from the vendor.

- Expense and corporate-card feeds flag line items that look like software but dodge procurement.

- Browser extensions or SSO logs cross-reference who is logging in and from which device.

Platforms such as Zylo merge those inputs into a living inventory. The result highlights a hidden layer that Forrester pegs at 60 percent of all SaaS apps in large enterprises. Security teams finally see tokens generated in ClickUp, legal teams learn which apps store data in non-compliant regions, and finance gains leverage before renewals land.

The cost of staying blind to these apps adds up quickly across security, compliance, and finance teams. In 2023, IBM’s Cost of a Data Breach report showed shadow-IT incidents averaging 20 percent higher remediation spend than breaches in sanctioned systems because owners and logs were unclear. Layer on audit failures such as HIPAA, SOC 2, or ISO 27001 violations, and the price of “unknown” keeps rising. Seeing every SaaS login in one dashboard is no longer a nice-to-have; it’s the first step to closing risk the CMDB can’t even see.

Digging Deeper Into SaaS Spend

License costs often slip by unnoticed when the invoice shows a single lump sum. Finance sees one line called “cloud software” and approves it. ServiceNow can assign that charge to a cost center, yet it never shows which managers own seats, why totals spiked, or which contracts renew next week. Without that view, trimming excess licenses is largely guesswork.

A dedicated SaaS management platform drags every invoice, contract, and usage log into one searchable place. It adds payment feeds from Expensify, API pulls from Slack, and DocuSign renewal notices, then builds a ledger the CFO will open. Each seat shows its monthly rate, owner, last login, and renewal clause side by side, turning scattered fragments into clear numbers.

Once everything is visible, you can score quick wins right away:

- Swap enterprise Slack Plus plans for cheaper Pro seats on channels used less than once a week.

- Merge idle Adobe Creative Cloud users into shared licenses, freeing about $600 per employee each year.

- Cancel duplicate project tools such as Monday and Asana that serve the same workflow for the same team.

- Downgrade Zoom webinar licenses when attendance data stays under 100 participants for six straight months.

Apply those tweaks to 200 apps, and the savings appear quickly. Companies that track licenses this closely typically cut 10 to 30 percent of SaaS costs within six months, with some topping a million dollars. Because the platform tracks renewals down to the day, procurement shows up to vendor meetings carrying real usage numbers, not a sales slide, and that tilts the call.

Salesforce offers a clear example because nearly every enterprise already uses it. If the dashboard shows only 60 percent of Marketing Cloud seats logged in over the last 90 days, cutting the extra 40 licenses is a safe move that saves about $48,000 a year. ServiceNow merely notes the contract, while a SaaS management platform points to the precise line you can eliminate.

Automating License Governance and Compliance

True license governance means acting on usage and policy data the moment it shifts, not days later.

ServiceNow’s licensing plugin mostly logs allocations, then waits for someone to review a report. A SaaS management platform turns that model around with automatic actions tied to every login. When a user stops signing in for 30 days, the system moves them to a free tier before the next billing cycle. If two accounts share the same email alias, the duplicate gets flagged instantly, not at quarter-end.

What makes the difference is continuous entitlement reconciliation that talks to identity providers, finance tools, and HR feeds in real time. For example, integrating Okta logins, NetSuite invoices, and Workday terminations into a single rules engine lets your team act faster than the next billing run. Within minutes of an employee exit, their Zoom, Asana, and Miro seats disappear, closed out with audit-ready proof. Gartner notes that firms using automated deprovisioning cut audit prep time by 65 percent and reduce true-up fees by half.

A mature platform also enforces policy well before trouble starts.

- Check MFA status against corporate standards every night

- Confirm data residency settings for apps handling customer PII

- Trigger a Jira ticket when an app’s new feature toggles default sharing to “public”

- Send a 90-day attestation reminder to the app owner, then freeze access if unanswered

Security teams follow the same real-time feed for risk scoring. License counts alone never reveal an admin account that still exists after role changes, or a marketing intern provisioning a HIPAA-scoped add-on. Continuous monitoring closes those blind spots without extra headcount.

Governance isn’t only about blocking; it’s also about right-sized enablement. Finance leaders increasingly focus on reallocating dormant seats to people who can use them, trimming renewals without hampering productivity. That simple loop can save double-digit percentages on renewals while boosting adoption metrics the CFO tracks. ServiceNow keeps the ticket history, yet the SaaS platform drives the decisions that keep auditors calm and budgets on track.

Bringing SaaS Management and ServiceNow Together

Hooking a SaaS management platform to ServiceNow turns scattered SaaS clues into ticket-ready ITSM events. Rather than ask teams to log into yet another console, the integration pushes new SaaS asset details straight into the CMDB that engineers already trust. When finance spots an unexpected Figma charge, the connector builds a CMDB record in minutes, adding owner, spend, and risk so ServiceNow rules kick off on their own.

Teams usually start with three low-lift patterns that bring fast results. The SaaS tool shares a simple JSON payload, ServiceNow transforms it with import sets, and business rules launch because the objects align with the CMDB hierarchy already in place.

Common examples include:

- Opening an incident whenever OAuth data shows an account on a banned app so the security desk can respond before a breach.

- Auto-generating a service catalog item that lets users request new seats on Slack or Zoom without manual form building.

- Feeding the GRC module with live risk scores so auditors see every unsanctioned login in one dashboard.

Keeping the flow in place calls for a straightforward framework. Stand up an API bridge; most SaaS discovery platforms provide ready-made ServiceNow endpoints so setup is more toggle than code. Map SaaS fields to CMDB classes; locking this schema early prevents duplicate CIs that skew reports later. Finally, split ownership: ITSM admins guard data quality while FinOps or procurement tracks renewals and handles integration requests.

Deploy both tools together and measurable gains surface almost immediately. Companies often cut new-app approval time from days to hours because the CMDB already knows the vendor’s risk tier and owner. Audit prep shrinks as screenshots give way to live dashboards that prove every account went through MFA and identity sync. Most teams say that once both systems talk in real time, executive reports finally list every application, not just the ones IT purchased.

Conclusion

ServiceNow keeps the lights on for IT operations, but SaaS still slips through cracks. A SaaS management layer spots the apps tucked behind credit cards and personal logins, filling in the blind spots your CMDB misses. Once the numbers are clear, finance and security start trimming waste, locking licenses, and dialing down risk. Plugging those insights into ServiceNow auto-creates tickets, updates the catalog, and shaves time off audits, letting both systems share the work.

Run them side by side and SaaS stops being chaos; IT can finally guide service, cost, and security from the same dashboard.

Audit your company’s SaaS usage today

If you’re interested in learning more about SaaS Management, let us know. Torii’s SaaS Management Platform can help you:

- Find hidden apps: Use AI to scan your entire company for unauthorized apps. Happens in real-time and is constantly running in the background.

- Cut costs: Save money by removing unused licenses and duplicate tools.

- Implement IT automation: Automate your IT tasks to save time and reduce errors - like offboarding and onboarding automation.

- Get contract renewal alerts: Ensure you don’t miss important contract renewals.

Torii is the industry’s first all-in-one SaaS Management Platform, providing a single source of truth across Finance, IT, and Security.

Learn more by visiting Torii.

Frequently Asked Questions

ServiceNow centralizes IT operations through incident management, change approvals, and problem reviews, allowing teams to streamline processes, enhance visibility, and maintain strong governance.

ServiceNow often misses browser-based SaaS applications because traditional discovery tools focus on data center assets, leaving personal-app usage unmonitored and potentially exposing security and compliance risks.

Implementing a SaaS management platform helps identify unused licenses, consolidate tools, and optimize renewals, leading to significant cost savings across multiple SaaS applications.

Automation enables proactive license governance by immediately adjusting user access based on login activity and contractual terms, reducing administrative workload and enhancing compliance.

Integrating a SaaS management platform with ServiceNow connects discovered SaaS applications to IT service management, streamlining incident creation, and enhancing data quality for audits.

Dashboards in ServiceNow provide real-time insights into incident resolution times, problem trends, change success rates, and other critical metrics for operational efficiency.

Understanding SaaS utilization is essential to managing security, compliance, and expenditure efficiently, helping organizations minimize risks and curb unnecessary costs related to unused applications.