Why Salesforce Contract Management Can’t Show License Usage in 2026

Salesforce Contract Management shows what was purchased, not what is in use. Procurement often assumes those records represent active seats, yet IT asset managers see information that’s already weeks or months old. That delay triggers a last-minute scramble for accurate counts at renewal time.

The mismatch occurs because Salesforce stores contracts, assets, and price books in separate tables designed for sales operations rather than usage tracking. Current seat counts live elsewhere, in authentication logs, vendor portals, or stray sandboxes, and they seldom intersect with contract data. Closing that gap demands both architectural know-how and the right tools.

This article explores the data Salesforce retains and explains why it leaves ITAM teams guessing. You will also see practical integrations that surface live license numbers in plain view.

Table of Contents

- What data does Salesforce Contract Management track?

- Why can't these fields show real-time usage?

- How does the visibility gap affect IT renewals?

- How can we surface license data in Salesforce?

- What criteria should guide ITAM solution choices?

- Conclusion

- Audit your company's SaaS usage today

What data does Salesforce Contract Management track?

Salesforce Contract Management stores plenty of commercial detail, but nothing about current license usage. Designed for sales operations rather than IT asset teams, the feature reuses the objects employed for quoting and renewal math. Contracts capture dates and terms, Assets log what was sold, and Orders list the line items that keep invoices in check. Because all three live in the CRM, they mirror the agreement at signature time and ignore everything that happens the next morning.

Here is a quick view of what those records keep on file:

- Contracts: start date, end date, auto-renew flag, and total contract value

- Assets: product SKU, quantity purchased, service-level tier, parent opportunity link

- Orders: price book entry, discount, amendment or original indicator, fulfillment status

- Price Books: catalog of SKU codes, list versus net price, regional currency

- Entitlements: support cases allowed, milestone targets, breach notifications

None of those fields updates after the ink dries on the deal. A rep might adjust the Quantity on an Asset when a mid-term upsell lands, yet that edit is manual and sporadic. When finance asks, “How many Marketing Cloud Pro seats are active right now?” the answer depends on whatever someone entered during the last amendment. Even the “Usage” field some orgs bolt on is a formula that divides revenue by list price; it guesses at seats and never counts them.

Static data becomes glaring in multi-product deals that evolve quickly. If a customer bought 500 Slack Enterprise seats and 100 Tableau Creator licenses, Salesforce copied two Asset lines and froze them at close-won. Six months later Slack admins might have issued 650 seats, while Tableau’s count slipped to 60 after a reorg. The Asset records still read 500 and 100 because they never touch authentication logs or vendor telemetry.

Admins try to patch the blind spot with custom report types, cross-object formulas, and Friday spreadsheets. Each stopgap still needs human upkeep, turning a live consumption question into a static snapshot that starts aging the second it is saved.

Why can’t these fields show real-time usage?

Salesforce fields give the impression of live data, but their figures stop moving once a rep hits Close Won. The platform never checks with the directories that decide who logs in, like Okta or Azure AD. Without that back-and-forth, a Quantity field just shows what the contract promised, not how many seats people use on a Tuesday afternoon.

Those seat counts live in places the glossy brochures skip.

- Vendor portals such as the Microsoft 365 Admin Center post a daily seat total that rarely matches the CRM.

- Identity providers keep session logs that show which named users signed in during any given day.

- Usage APIs from tools like Zoom list who hosted meetings, not what the contract says.

Each source tracks sign-ins or feature use, while Salesforce worries about revenue, so the numbers never line up without extra work.

Multi-org setups blur the picture further when one company runs a maze of production, sandbox, and developer orgs. Permission sets rarely match between them, so a “Sales Cloud User” in Org A could translate to eight add-ons in Org B. Clone a sandbox and every dormant account rides along, inflating any script that tries to count active seats across environments.

Nightly import jobs alone won’t resolve or fix the persistent gap. Salesforce API limits squeeze large payloads, and most SaaS endpoints allow only hourly calls. A schedule can’t capture a noon rush; seats can spike by hundreds between syncs. By the time the batch runs, the “current seats used” figure is already stale.

Corporate security and compliance rules ultimately close the loop on data flow. Contract objects sync to Finance and Procurement profiles that neither need nor should hold personal data. Pushing email addresses or login times into those records risks GDPR and CCPA fines, so IT masks or drops the very fields auditors want for proof. Until the architecture, policy, and APIs play nicely together, real-time license counts will stay outside Salesforce Contract Management.

How does the visibility gap affect IT renewals?

Without live usage data, contract records read like educated guesses, not guidance. At budget time, procurement teams pull the static seat counts, assume they’re correct, and lock in dollars they may never use. Spread that waste across a typical SaaS estate and the total swallows most innovation budgets.

Under-counting hurts just as much, but the pain shows up as audit penalties.

- Overrun invoices arrive after the renewal is signed, when leverage is gone.

- Security teams scramble when inactive identities in vendor portals outnumber those in Salesforce.

- Finance wonders why headcount falls while subscription totals climb.

- IT scrubs user lists line by line before true-ups.

- Analysts lose days building pivot tables nobody fully trusts.

Every time the data conflicts with reality, hours go into defending a number instead of improving the plan, and frustration travels from desk to desk.

SAP’s £54 million judgment against Diageo shows how unseen consumption can land in courtrooms, not just spreadsheets. The company’s CRM triggered indirect SAP access that never appeared in its contract tracker, and nobody flagged it until lawyers did, turning a licensing oversight into a headline. At the other end of the spectrum, Flexera’s 2023 “State of ITAM” survey found 32 percent of SaaS spend sits unused, money that could fund cloud migrations, security upgrades, or new hires.

These blind spots also derail ISO 19770 and ITIL software asset management routines. Verification relies on matching entitlements to installs; without usage feeds, that cross-check fails, and auditors mark the file incomplete. Optimization, the phase meant to cut the next renewal, devolves into a guessing game fed by stale exports. Until contract terms and consumption data sit in the same dashboard, ITAM stays reactive and every renewal begins with a scramble rather than a plan.

How can we surface license data in Salesforce?

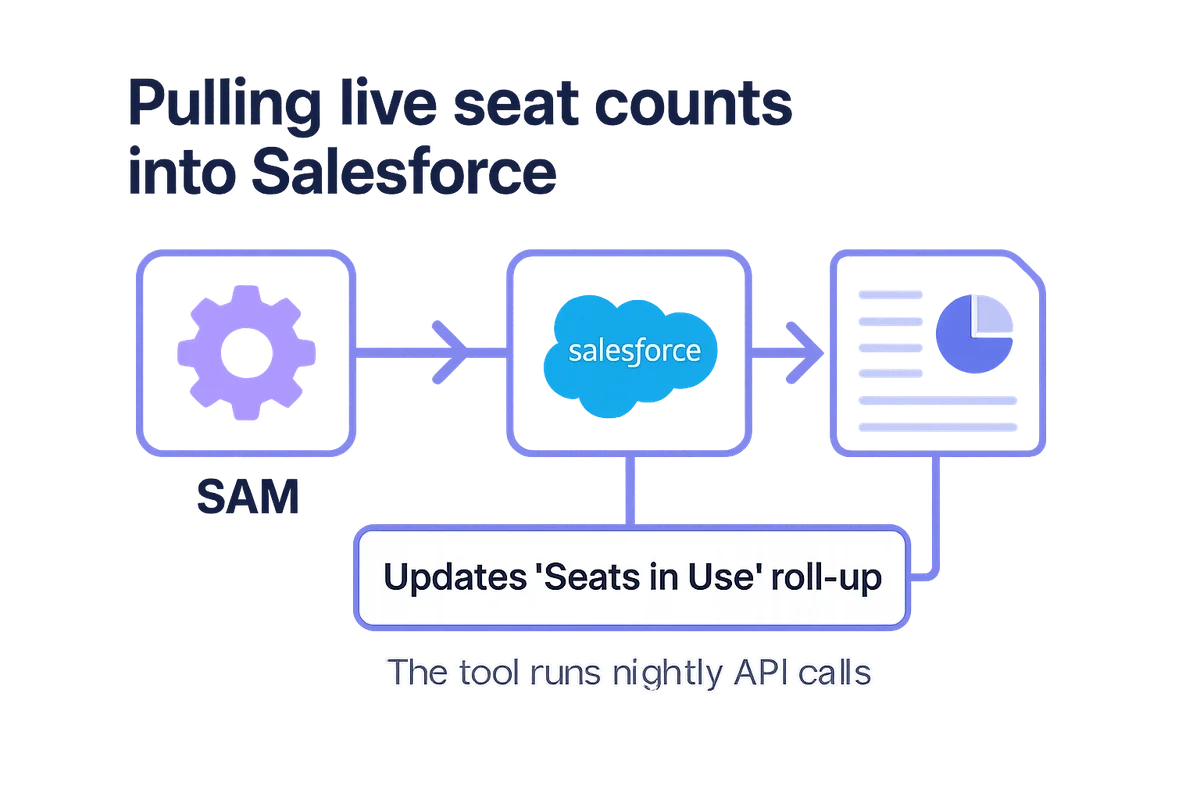

Pulling live seat counts into Salesforce isn’t rocket science today. Install a Software Asset Management (SAM) app from AppExchange and aim its connector at your busiest SaaS vendors. The tool runs nightly API calls, stores raw usage in a custom object, and updates a “Seats in Use” roll-up on the linked Contract. Since the package handles retries and rate limits, admins spend their time acting on data instead of chasing failed jobs.

Some teams want more control, so they skip packaged tools and build their own integration. Apex callouts can reach vendor endpoints, parse JSON, and drop the payload into a purpose-built License_Consumption__c object. Set refresh intervals to match contract risk; business-critical suites may run hourly, while niche tools can wait a day. Log response time, record count, and any parsing errors so a dashboard can flag feeds that fall behind.

Reliable middleware helps most when dozens of apps are in play. A low-code hub such as MuleSoft or Boomi can land consumption events once, change them, and send them to Salesforce, data lakes, or finance in a single flow. Field mapping stays simple because you manage one canonical schema instead of tweaking every Apex class when a vendor changes its API.

Wherever the data lands, show the numbers where decision makers already work. Add a License tab to the Contract page, reveal delta-against-purchased seats, and trigger an email alert when usage reaches 90 percent. Avoid compliance headaches by encrypting personal identifiers and storing OAuth tokens in Named Credentials, not custom settings.

- Set validation rules that block renewal quotes if usage data is older than seven days

- Create a scheduled job that deactivates inactive sandbox copies from consumption totals

- Use role hierarchy to hide user-level data from sales reps but share summaries with finance

Automated license feeds turn static contract records into living dashboards that spot waste, tighten renewals, and reduce audit risk.

What criteria should guide ITAM solution choices?

At some point, every ITAM project reaches a point where picking the right tool determines if the data earns trust or ends up ignored.

Before vendor demos start, list the requirements that cannot bend. The tool must pull daily counts from Okta, Microsoft 365, and niche SaaS apps without custom code. Audit teams need to trace every row back to the originating API call. The fastest way to keep those points straight is a simple checklist:

- Connector coverage across the top 100 SaaS publishers

- Immutable usage logs that survive deletions and merges

- Reconciliation flows that flag mismatched seats, not just total variances

- Optimization analytics that suggest actions instead of serving up charts

- Role-based alerts sent to Slack, email, or Salesforce Chatter within minutes

Salesforce-native add-ons feel comfortable because renewal managers already spend half the day in that tab set. Comfort, however, fades if the package clutters page layouts or forces extra clicks to compare entitlements with usage. External dashboards like Zylo excel at visual discovery yet create a second source of truth. Gauge adoption risk by counting how many user groups would need to juggle both screens during a renewal cycle and by checking whether single sign-on is included instead of an upsell.

Total cost of ownership stretches well beyond the subscription line item. Map every connector that needs maintenance, every field that triggers a workflow, and every audit report finance requests. Platform charges from Salesforce Storage or Snowflake ingest accumulate fast; so do consultant hours when an API is deprecated.

Start small instead of trying to inventory the entire stack on day one. Pick the five SaaS categories with the highest spend or the highest risk, whichever keeps leadership awake. Measure success in plain numbers: surplus seats cut by 20 percent, manual reconciliation time down to one hour a week, true-up surprises eliminated. Track those metrics for two quarters and expand only when evidence shows the visibility gap is closing.

Conclusion

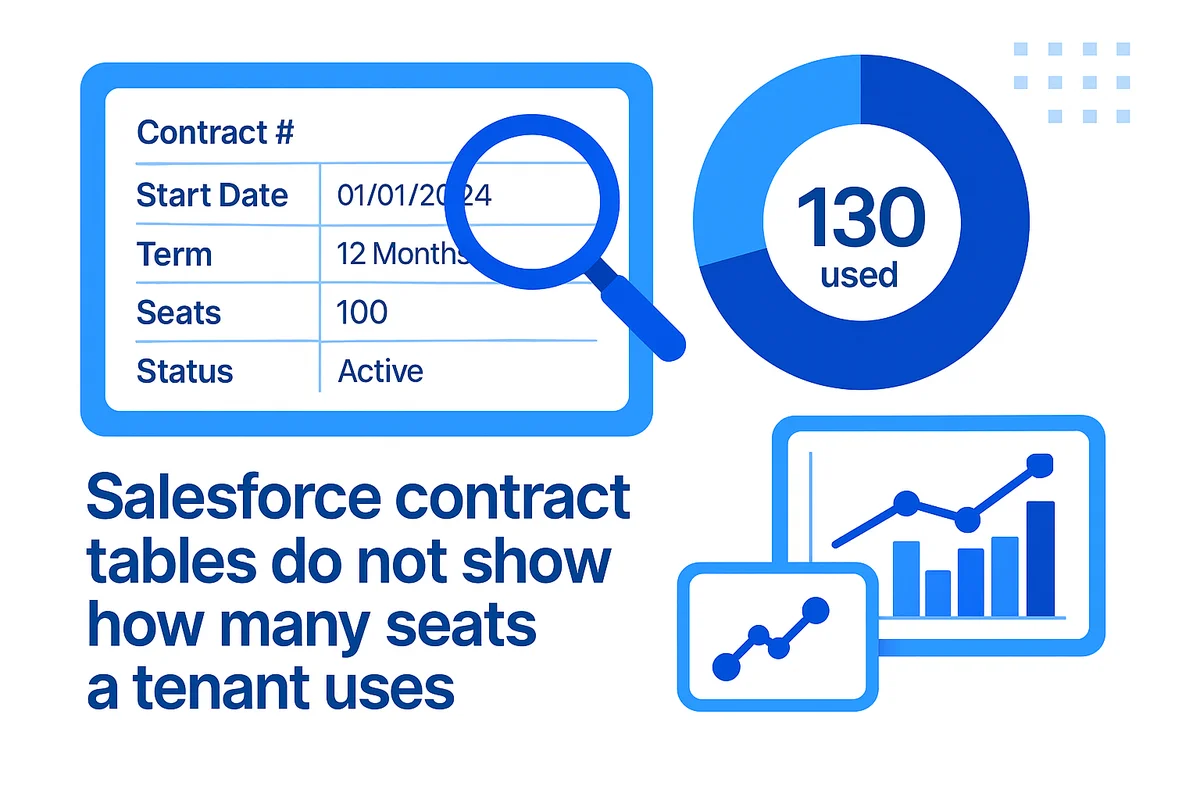

Salesforce’s contract tables do not show how many seats a tenant uses. We reviewed the fields that are captured, noted that authentication data sits in other logs, and mapped how hidden usage inflates budgets, raises compliance risks, and erodes renewal leverage. Then we summarized the plug-in and integration options that expose real-time consumption.

Choosing among AppExchange apps, middleware, and custom code depends on connector availability, data lineage, cost, and how quickly a pilot can prove value. Salesforce can manage the contracts, but only live usage data can change it into the central record ITAM teams require.

Audit your company’s SaaS usage today

If you’re interested in learning more about SaaS Management, let us know. Torii’s SaaS Management Platform can help you:

- Find hidden apps: Use AI to scan your entire company for unauthorized apps. Happens in real-time and is constantly running in the background.

- Cut costs: Save money by removing unused licenses and duplicate tools.

- Implement IT automation: Automate your IT tasks to save time and reduce errors - like offboarding and onboarding automation.

- Get contract renewal alerts: Ensure you don’t miss important contract renewals.

Torii is the industry’s first all-in-one SaaS Management Platform, providing a single source of truth across Finance, IT, and Security.

Learn more by visiting Torii.

Frequently Asked Questions

Salesforce Contract Management tracks contracts, assets, orders, price books, and entitlements, but doesn’t provide real-time license usage data, only static information at the time of agreement.

Salesforce fields stop updating after a deal closes and do not connect with directories like Okta or Azure AD, leading to outdated contract data that doesn't reflect actual usage.

The lack of live usage data causes procurement to operate on outdated assumptions, leading to potential overpayments and audit penalties, wasting both time and resources.

To show live seat counts in Salesforce, integrate a Software Asset Management app or build custom integrations that pull real-time usage from vendor APIs.

Select ITAM solutions based on connector coverage, accurate usage logs, reconciliation flows, optimization analytics, and timely alerts to ensure data reliability and compliance.

Outdated license data can lead to budget overruns, compliance issues, and audit penalties, as it disconnects financial planning from actual software usage.

Automation can streamline IT tasks, ensure timely contract renewals, and help identify unused licenses, thereby optimizing costs and reducing human error in SaaS management.