Are Monthly or Yearly SaaS Contracts More Common in 2026?

Every SaaS buyer wrestles with one basic billing choice: pay month to month or lock in an annual term. What looks like a small billing tweak hits budgets, procurement workloads, renewal forecasts, and even how fast product teams can shift when priorities change.

Finance teams understand the basic cost math within minutes of review. Context then drives the choice, because factors such as cash preservation, shifting project timelines, and alignment with capital-approval cycles all influence the level of commitment a team can accept. Add vendor spiffs, shifting roadmaps, and data-residency promises, and both sides recalculate the numbers almost every quarter.

Line up the stats, cash flow, supplier motives, and renewal mechanics, and the real winners come into focus. Pick the wrong term and value leaks fast; pick the right one and it compounds over the contract life.

Table of Contents

- How common are monthly vs annual SaaS contracts?

- How does company size affect contract terms?

- How do product factors influence contract length?

- How do contract terms impact license management?

- Conclusion

- Audit your company's SaaS usage today

How common are monthly vs annual SaaS contracts?

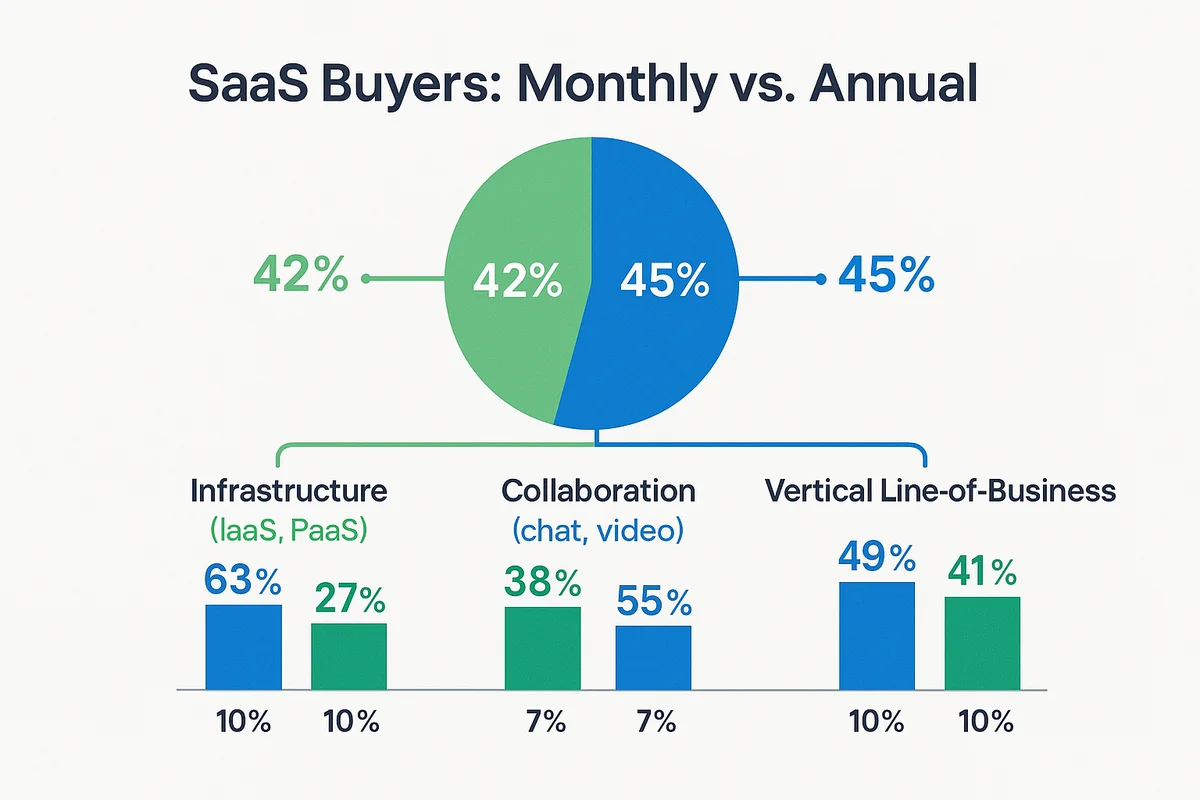

SaaS buyers now split almost down the middle between monthly and annual subscriptions. Gartner’s latest seat-level billing sample shows 42% monthly and 45% annual, with the balance in multi-year or usage plans. Blissfully’s 2024 SaaS Spend Index tells a similar story at 40/50/10 across 10,000 invoices. Year-over-year shifts are modest, yet certain product lines move more than others.

Infrastructure platforms lean toward yearly commitments because finance and ops teams value predictable capacity planning. Collaboration suites still tilt shorter, while niche vertical apps sit somewhere between the two. Adoption rates shake out like this:

- Infrastructure (IaaS, PaaS): 63% annual, 27% monthly, 10% usage-only

- Collaboration (chat, video, docs): 38% annual, 55% monthly, 7% usage-only

- Vertical line-of-business software: 49% annual, 41% monthly, 10% usage-only

Invoice records from Zylo and other spend-management platforms show why the “other” bucket keeps growing. Pay-as-you-grow contracts, essentially monthly bills that climb automatically when seats are added, now capture close to 12% of net-new SaaS spend; that share was only 4% in 2021. Vendors market the approach as flexible, yet most still embed annual price floors for large customers, making the monthly-versus-yearly line fuzzy.

Geography often changes subscription habits more than many teams expect. North American vendors push harder for annual prepay, posting a 52% annual average in the procurement datasets, while European sellers sit at 39%. Part of the gap traces back to financing norms: U.S. Firms lean on deferred revenue to impress investors, since many EU providers focus first on retention metrics.

Analysts expect hybrid terms to grow gradually rather than a sudden swing one way or the other. Procurement teams should treat billing cadence as a variable worth tracking, and contract analytics must evolve with the mix.

How does company size affect contract terms?

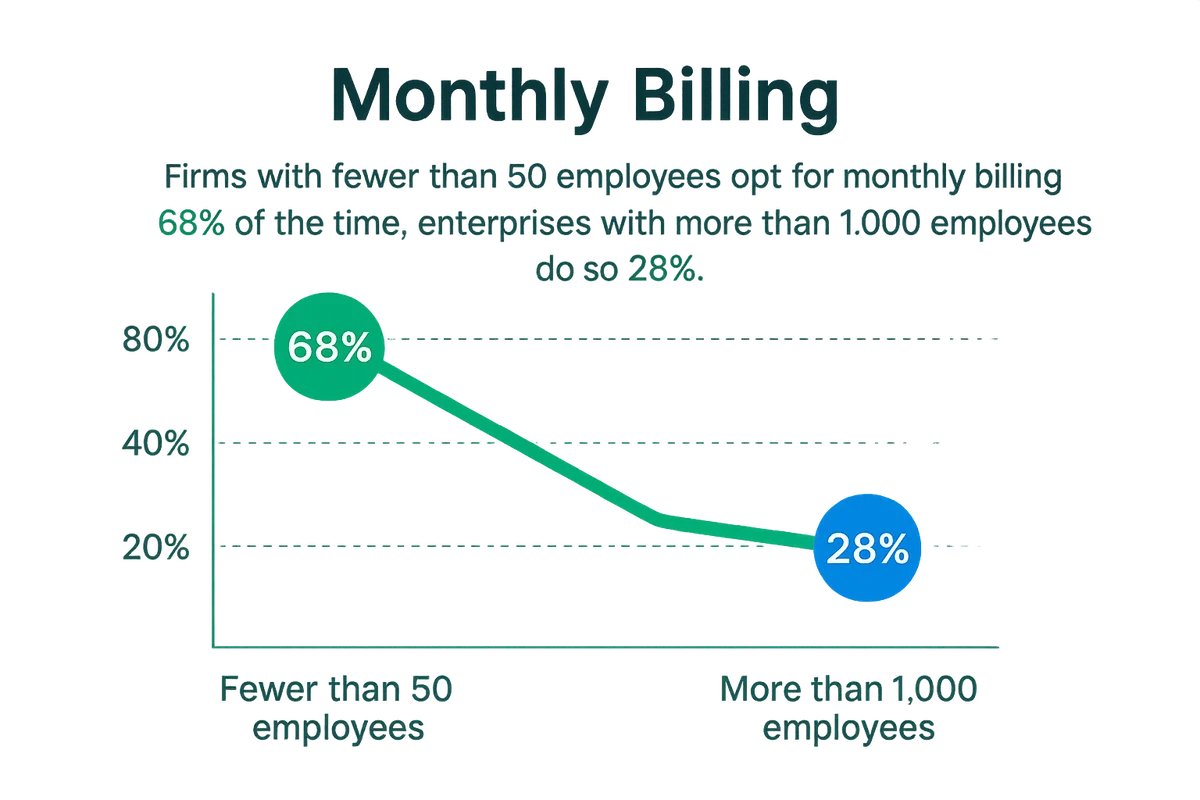

Contract term length often follows the size of a company’s cash cushion and approval process. Recent data from Blissfully’s SaaS Trends show that firms with fewer than 50 employees opt for monthly billing 68 percent of the time, while enterprises with more than 1,000 employees do so only 28 percent, confirming that runway and red tape move in opposite directions.

Early-stage start-ups live on a rolling 12-to-18-month cash forecast, so each prepaid dollar shrinks their oxygen tank. Finance leaders prefer to pay a 10 percent premium each month rather than wire a lump sum that erodes runway and complicates investor metrics such as burn multiple. Because many of these companies book software as an operating expense, spreading payments keeps the P&L clean and makes it easier to dial usage up or down between funding rounds.

Mid-market firms often find themselves stuck in an awkward middle ground. They have steadier revenue than a seed outfit yet lack the sprawling procurement desks of a Fortune 500. Their choice often depends on banking covenants and seasonal cash swings. When receivables spike after Q4, they prepay to lock pricing; when cash is tight, they revert to monthly without apology.

Large enterprises tell a far different story when it comes to billing cycles. Annual contracts match fiscal calendars, simplify accrual accounting, and align with the capital committee that meets only twice a year. A 2023 Gartner survey found 74 percent of companies above $5 billion in revenue bundle SaaS into multi-year capital expenditure plans, treating licenses like servers once were. Predictable spend also strengthens discount negotiations and feeds into ERP suites such as Oracle NetSuite that rely on fixed amortization schedules.

Ask any CFO and you will hear that the debate ultimately centers on risk. Shorter contracts guard against overpaying for shelf-ware if a merger, pivot, or head-count freeze lands unexpectedly; longer contracts guard against inflation, price hikes, and budget rollovers that might deny funds later. In practice the decision funnels into a simple matrix:

- Start-ups: protect runway, choose monthly, accept higher headline rate

- Mid-market: toggle based on cash cycles and banking terms

- Enterprises: fix cost, choose annual, prioritize governance and approval rhythm

Knowing where your organization sits on that spectrum clarifies which knob, liquidity or predictability, needs the most careful tuning.

How do product factors influence contract length?

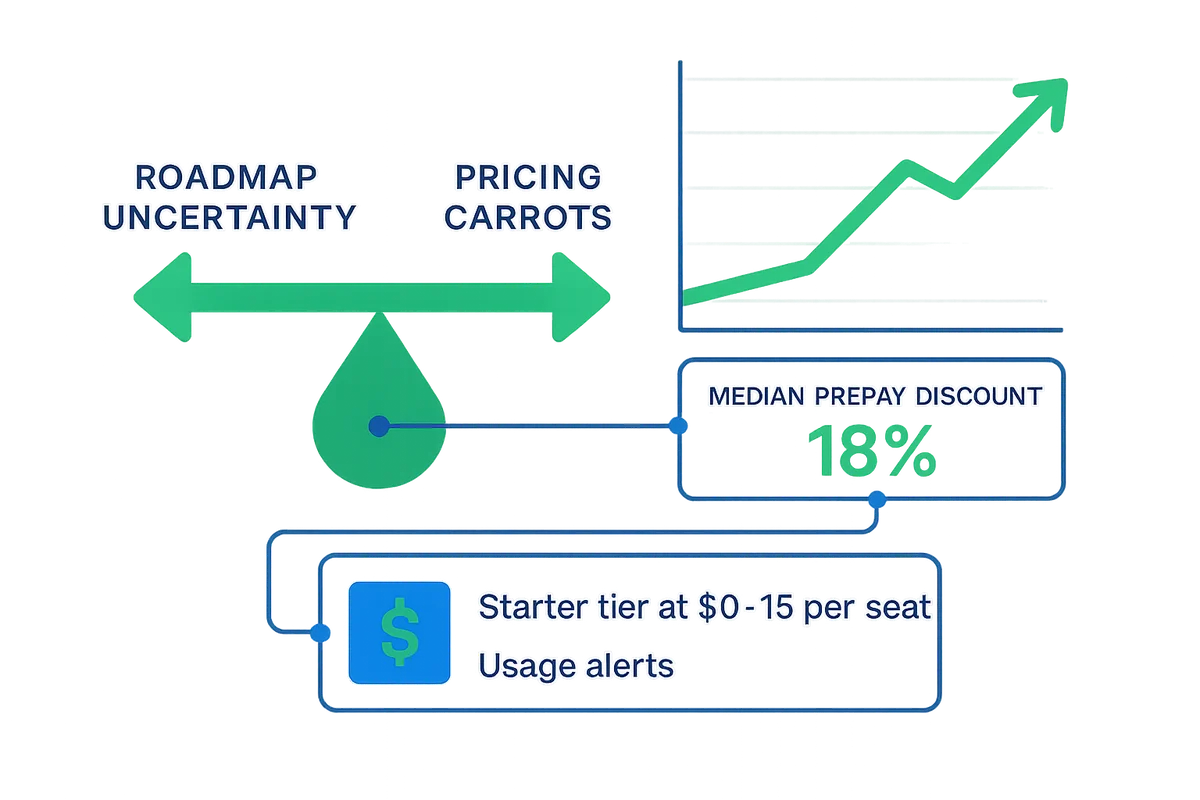

Contract length often boils down to a tug-of-war between roadmap uncertainty and pricing carrots. Buyers like predictable budgets, yet they hesitate to fund multi-year promises that may never leave the sprint board.

Most vendors no longer bother hiding the math behind those carrots. A 2024 Vendr dataset pegs the median annual prepay discount at 18 percent, and tiered programs from Atlassian and Okta climb to 25 percent for multi-year signatures that freeze rates. Finance teams study those slides and weigh them against the risk of paying for features still on the backlog, which is why discount ladders now include “future service credit” clauses meant to calm buyers burned by vaporware.

Product-led growth companies complicate things by defaulting to swipe-your-card monthly plans, then dangling upgrades once usage spikes. The familiar land-and-expand recipe looks like this:

- Starter tier at $0–$15 per seat, billed monthly to remove friction

- Usage alerts that appear around 70 percent of quota, nudging admins toward premium seats

- A “convert to annual and save 20 percent” pop-up bundled with concierge onboarding

- Renewal co-terming that lets add-ons share the original anniversary date

Rapidly evolving feature sets also push buyers toward shorter, more flexible contract cycles.

Mid-term upgrade clauses now offer a practical middle path for both camps. Buyers negotiate the right to re-rate or downgrade licenses after six months if adoption stalls, while vendors keep a true-up option when headcount balloons. These levers turn a rigid annual contract into something closer to a rolling option, giving both sides room to adapt without restarting procurement from scratch. The structure keeps revenue predictable for the seller and preserves optionality for the customer, no CFO wants to pay for mothballed seats, and no CRO wants surprise churn at quarter-end.

How do contract terms impact license management?

License cadence quietly rewrites the playbooks finance, IT, and procurement teams counted on. Those rapid-fire renewals reshuffle budgets, processes, and accountability before anyone has time to print last month’s report.

Monthly terms start a rolling cycle of micro-renewals, forcing managers to forecast spend every thirty days while chasing usage data that is already stale. An annual contract, by contrast, folds risk into one decision point; the upside is simpler budgeting, the downside is a bigger miss if headcount drops mid-year. Because shelf-ware often hides behind “set-and-forget” licenses, Gartner pegs wasted SaaS spend at 25% of total outlay for firms running more than fifty apps.

Teams that pull real-time telemetry from SaaS management platforms such as Productiv cut that waste nearly in half. They feed login and API data back into renewal calendars, turning gut feel into evidence. Still, data without process stalls. Managers who only check dashboards before anniversary dates miss month-to-month churn signals that point to over-provisioned seats or dormant feature tiers.

Operationally mature teams stitch cadence, data, and clear ownership together:

- Build one renewal calendar that flags expirations 90, 60, and 30 days in advance.

- Sync the calendar with Slack or email so app owners, not admins, receive the alerts.

- Tag each contract with the system of record that holds usage metrics.

- Pair monthly plans with lightweight churn reviews; reserve annual true-ups for deep dives into seat counts and feature adoption.

- Document renegotiation notes in the same ticket to preserve context for the next cycle.

SOX auditors increasingly expect and verify that level of traceability. A clear line from contract to usage evidence proves controls, while eliminating the scramble for PDFs during testing. Even so, process debt lurks when firms juggle forty or more monthly renewals; procurement ends up playing whack-a-mole and misses strategic sourcing opportunities. Some enterprises move low-risk apps into consolidated annual bundles just to reclaim analyst hours. Others ask vendors for self-service portals so license counts can be adjusted mid-term without a fresh SOW. Whichever mix you choose, lock rules early and revisit them quarterly, because waiting until the invoice lands is the costliest workflow of all.

Conclusion

SaaS buyers don’t pick contract terms just to shave dollars off the bill. Instead, they weigh a range of trade-offs behind every option. Monthly and annual plans still split the market, yet usage-based blends are gaining ground in almost every segment. Early-stage firms guard runway, mid-market teams follow budget calendars, and large enterprises swap flexibility for predictable spend. On the vendor side, discounts, feature roadmaps, and renewal carrots often spill into extra license-tracking work for finance.

Pick the rhythm that fits your cash flow and your tolerance for renewal drama. That timing decision will affect savings, forecasting effort, and more than a few nights of sleep.

Audit your company’s SaaS usage today

If you’re interested in learning more about SaaS Management, let us know. Torii’s SaaS Management Platform can help you:

- Find hidden apps: Use AI to scan your entire company for unauthorized apps. Happens in real-time and is constantly running in the background.

- Cut costs: Save money by removing unused licenses and duplicate tools.

- Implement IT automation: Automate your IT tasks to save time and reduce errors - like offboarding and onboarding automation.

- Get contract renewal alerts: Ensure you don’t miss important contract renewals.

Torii is the industry’s first all-in-one SaaS Management Platform, providing a single source of truth across Finance, IT, and Security.

Learn more by visiting Torii.

Frequently Asked Questions

SaaS buyers are nearly split between monthly and annual subscriptions, with figures reportedly at 42% monthly and 45% annual subscriptions according to recent studies.

Smaller firms typically prefer monthly contracts due to cash flow, while larger enterprises favor annual terms for predictability and budget alignment, highlighting a clear divide based on company size.

Product factors like roadmap uncertainty and available discounts push buyers to evaluate contract lengths, resulting in varied preferences for shorter or longer commitments based on perceived value.

Contract terms significantly affect license management, with monthly renewals prompting continuous budget monitoring, while annual contracts consolidate risk into singular decision points, affecting efficiency and accountability.

The choice between monthly and annual contracts involves assessing cash flow, renewal drama, and potential savings, influencing long-term budgeting and operational flexibility for organizations.

Analysts predict a gradual rise in hybrid subscription models, as companies increasingly seek to balance flexibility and predictability in their SaaS purchasing decisions.

To optimize SaaS usage, organizations should leverage management platforms for visibility, automate contract renewals, and maintain a clear record of software licenses for efficient tracking.